If you operate a business in Colorado but the owners live in another state, a recent tax policy change affects you. Previously, Colorado allowed businesses choose from three methods to ensure their out-of-state owners paid state taxes. However, starting with the 2024 filing, businesses must take a bigger role in making sure taxes are paid.

How It Worked Before

Businesses had three options to handle taxes for non-resident owners:

- DR 107 Agreement – The nonresident owner agreed to pay their own Colorado taxes.

- DR 108 Filing – The business paid the tax on behalf of the nonresident owner (this option is now eliminated)

- SALT Parity Act Election – The business chose to pay taxes for all owners, both in and out of state.

Of the three methods, there was no strict rule on which to use. However, Colorado reserved the right to take action against the company if a nonresident owner failed to pay their taxes.

What’s Changing?

Starting in 2024, Colorado now requires businesses to calculate and pay the taxes for their nonresident owners using a composite return—unless you have a DR 107 agreement in place or opt into the SALT Parity Act. Furthermore, the DR 108 Filing option is now eliminated.

What You Need to Do

To avoid completing a composite return, paying tax for nonresidents only, businesses need to:

- Get a signed DR 107 form from nonresident owners on file (once signed, it’s valid indefinitely and a smart move for long-term compliance)

- Or choose the SALT Parity Act to handle taxes for all owners, both in and out of state.

Pro Tip

With Colorado increasing their scrutiny on nonresident income, you and any new business owners should be proactive about obtaining a signed DR 107 Form. Adding it to your organizational agreements ensures it’s handled upfront, saving you from last-minute tax headaches down the road.

For more information on the DR 107, see the Department of Revenue at https://tax.colorado.gov/DR0107.

Colorado Springs, Co. – Stockman Kast Ryan + Co, LLP (SKR+CO), a leading locally-owned certified public accounting firm in Colorado, welcomes three exceptional team members to the Partner Group.

“It is with great pride that we welcome Danielle Gaffney, Jena Fogle and Josh Olson to the partner group” shared SKR+CO Managing Partner Jordan Empey. “Their proven leadership, commitment to client service, and strategic vision make them invaluable assets to our firm. We look forward to partnering with them on taking the firm into the future for our clients, staff, and community.”

Danielle Gaffney, CPA, MST, was promoted to Tax Partner at SKR+CO. Danielle brings over a decade of experience in the public accounting industry and specializes in mergers & acquisitions, real estate transactions, and working with groups of closely held businesses and the individual owners. In addition to being a CPA, a Master of Science in Taxation from D’Amore-McKim School of Business at Northeastern University, Boston, MA. In 2020, Danielle was recognized a Rising Star by the Colorado Springs Business Journal.

Jena Fogle, CPA, MSA, was promoted to Audit Partner at SKR+CO. Jena has been in public accounting since 2009 and specializes in employee benefit plans, financial institutions, small businesses, construction and nonprofit audits. In addition to being a CPA, Jena holds a Master of Accountancy from Drake University, Des Moines, IA.

Josh Olson, CPA, was promoted to Tax Partner at SKR+CO. Josh started his accounting career in 2012 and has extensive experience working with closely held businesses, C-corporations, S-corporations, partnerships, limited liability companies, individuals, nonprofit organizations, real estate entities and medical practices. In addition to being a CPA, Josh holds a Bachelor of Science from University of Wyoming, Laramie, WY.

About Stockman Kast Ryan + Co

SKR+CO is one of Colorado’s largest independent certified public accounting firm providing a variety of in-depth consulting for businesses and individuals. Advisory services include tax planning, audit and assurance services, outsourced controller and contract CFO, financial reporting, estate planning, business valuations and litigation support. For more information, visit www.skrco.com. SKR+CO is an independent member firm of the BDO Alliance USA, a nationwide association of independently owned local and regional accounting, consulting and service firms with similar client service goals.

Colorado Springs, Co. – Stockman Kast Ryan + Co, LLP (SKR+CO), one of Colorado’s largest locally-owned certified public accounting firms in Colorado, is proud to announce the appointment of new leadership roles within the firm.

Jordan Empey has been named as the firm’s Managing Partner. Jordan brings a wealth of knowledge and leadership to his new role. He is committed to driving the firm’s strategic initiatives forward while maintaining a strong focus on client service and satisfaction.

Joining Jordan in key leadership positions are Buddy Newton, who will serve as the firm’s Tax Partner in Charge, and Kyle Hinger, who will take on the role of Client Advisory Services Partner in Charge. Buddy and Kyle will both play a crucial role in guiding the departments towards continued growth and success.

“We are pleased to announce these well-deserved appointments,” said Ann Koenigsman, Tax Partner. “Jordan, Buddy, and Kyle have all demonstrated exceptional leadership abilities and a deep commitment to our firm’s core values. We are confident that they will excel in their new roles and lead our team to even greater heights.”

As Managing Partner, Jordan will oversee the firm’s overall operations and strategic direction, working closely with the partner group to drive growth and innovation. Buddy and Kyle will be responsible for leading their respective departments, ensuring the delivery of high-quality services to clients and fostering a culture of excellence.

Please join us in congratulating Jordan, Buddy, and Kyle on their new roles. Their leadership will play a vital role in shaping the future success of Stockman Kast Ryan + Co.

About Stockman Kast Ryan + Co

SKR+CO is one of Colorado’s largest independent certified public accounting firm providing a variety of in-depth consulting for businesses and individuals. Advisory services include tax planning, audit and assurance services, outsourced controller and contract CFO, financial reporting, estate planning, business valuations and litigation support. For more information, visit www.skrco.com. SKR+CO is an independent member firm of the BDO Alliance USA, a nationwide association of independently owned local and regional accounting, consulting, and service firms with similar client service goals.

Colorado Springs, CO. – Stockman Kast Ryan + Company

SKR+CO is delighted to announce that Beth Backora, a valued member of our team, has been honored with a Gold Key Award from the Colorado Society of CPAs (COCPA). Each year, the COCPA Educational Foundation recognizes outstanding accounting students across the state who are setting high standards for academic achievement.

Audit Consultant Beth Backora, who attends the University of Colorado – Colorado Springs (UCCS), has been awarded a Gold Key Award for achieving the highest cumulative grade point average of any graduating senior in the School of Accountancy from her institution. Her dedication and exemplary performance have earned her this recognition, showcasing her as a leader in the School of Accountancy.

“We are incredibly proud of Beth for her well-deserved recognition,” said Steve Hochstetter, Audit Partner at SKR+CO. “Her commitment to excellence and relentless drive for success exemplifies the core values upheld here at SKR+CO.”

Beth’s achievement underscores SKR+CO’s commitment to providing exceptional service to our clients. As a leading CPA firm in Colorado, we continue to uphold the highest standards of professionalism while meeting the unique needs of our clients.

About SKR+CO: SKR+CO is a leading and award-winning accounting firm providing comprehensive services to clients in Colorado Springs, Denver and beyond. With a team of experienced professionals, we offer a wide range of services, including include tax planning, audit and assurance services, outsourced controller and contract CFO, financial reporting, estate planning, business valuations and litigation support. Our commitment to excellence and client satisfaction sets us apart as a trusted partner in our clients’ success. SKR+CO is an independent member firm of the BDO Alliance USA, a nationwide association of independently owned local and regional accounting, consulting and service firms with similar client service goals.

Colorado Springs, CO. – Stockman Kast Ryan + Co, LLP (SKR+CO), the largest locally-owned certified public accounting firm in Southern Colorado, announces recent staff promotions.

Stephanie Cantrell – Promoted to Supervising Tax Senior

Stephanie has an Associate of Liberal Arts from Chattahoochee Valley Community College, a Bachelors of Business Administration, with an emphasis in Accounting from Campbell University and a Masters of Business Administrations, Accounting Cognate from Liberty University. She has been in public accounting since she joined us in January 2021.

Samuel Eden – Promoted to Supervising Tax Senior

Sam has a Bachelor of Science in Business, with an emphasis in Accounting from UCCS. He has been in public accounting since joining us in January 2021.

Caroline Kamppila, CPA – Promoted to Supervising Audit Senior

Caroline has a Bachelor of Science in Business Administration, with an emphasis in Supply Chain Management from Colorado State University. She has been in public accounting since she joined us in January 2020.

Eric Mueller – Promoted to Senior Tax Manager

Eric has a Bachelor of Accounting from the University of Minnesota. He started in public accounting January of 2013 and joined us in January of 2018.

Adison Simoff – Promoted to Tax Senior

Adison has a Bachelor of Science Psychology from Colorado State University and a Graduate Certificate in Accounting from the University of Colorado Springs. She started in public accounting January of 2021 and joined us in May of 2021.

Brittany Updike – Promoted to Supervising Tax Senior

Brittany has a Bachelor of Science with an emphasis in Accounting and a Masters of Science in Accounting from UCCS. She has been in public accounting since she joined us in January 2020.

Colorado Springs, Co. – Stockman Kast Ryan + Co (SKR+CO), proudly announces the addition of Kyle Hinger, CPA, as the newest member of the SKR+CO partner group, marking the twelfth partner of the firm. With over 15 years in public accounting, Kyle joins the Denver office, bringing a wealth of experience in assurance services to a wide array of industries. His expertise extends beyond standard audits, encompassing reviews, compilations, EBP audits, agreed-upon procedures, and due diligence. Kyle’s adept leadership ensures alignment with professional standards, regulations, and consistently surpasses client expectations across diverse sectors.

As SKR+CO continues to expand its footprint in the Denver market, Kyle’s arrival is anticipated to play a pivotal role in this growth trajectory. His unwavering dedication to excellence and client satisfaction perfectly aligns with the core values upheld by SKR+CO, promising a positive impact on both the team and clientele.

Stockman Kast Ryan + Co to Open Denver Tech Center Location

Local accounting firm expands

Colorado Springs, Colo. – Stockman Kast Ryan + Co, LLP (SKR+CO) is expanding its presence in Denver with a new 4,200-square-foot office in Greenwood Village.

A community-focused, full-service public accounting firm that is headquartered in Colorado Springs, SKR+CO’s Denver office will open in Summer 2023 with nine offices, one conference room and shared workspaces for a total of 23 employees. Construction is currently in progress.

Tax Partner Ann Koenigsman will be the Partner-in-Charge of opening the Denver location.

“We are delighted to announce the opening of our new office in the Denver Tech Center,” said Koenigsman, who specializes in Trusts, Estates, and Family Office Services. “This expansion is a significant milestone for our firm, and it is a testament to the hard work and dedication of our team. The new office will provide us with a strategic presence in the Denver market, allowing us to better serve our Denver clients and meet their evolving needs. We are excited about the opportunities this new office brings, and we look forward to continued growth and success.”

SKR+CO has served many business and individual clients in the Denver metro area for decades. In December 2022, SKR+CO grew its in-person Denver presence by partnering with Chris Hambor, CPA, formerly of Singular CPA. Adding the new office is a response to consistent client growth along the Front Range, and the Denver-based staff will provide greater face-to-face client services in the metro area. Recruiting and hiring efforts are underway for tax, audit, and operations professionals, with in-office, virtual, and hybrid options available for many positions.

SKR+CO is an award-winning accounting firm, recently named a 2023 Regional Leader by Accounting Today and ranked Best in Business in 2022 by the Colorado Springs Business Journal.

###

About Stockman Kast Ryan + Co.

SKR+CO is a community-focused, Colorado-owned, independent certified public accounting firm providing a variety of in-depth consulting for businesses and individuals. Advisory services include tax planning, audit and assurance services, outsourced controller and contract CFO, financial reporting, estate + trust planning, business valuations, and litigation support. SKR+CO is headquartered in Colorado Springs, with a second office in Denver. SKR+CO is an independent member firm of the BDO Alliance USA, a nationwide association of independently owned local and regional accounting, consulting, and service firms with similar client service goals. For more information, visit www.skrco.com.

Beginning January 1, 2023, meal and entertainment deductions will revert to tax rules under Tax Cuts and Jobs Act (TCJA). These deductions temporarily changed for tax year 2021 and 2022 with the passing of the Consolidated Appropriations Act of 2021. For tax year 2023, many of the meal and entertainment deductions reduce from 100% deductibility to 50% deductibility. Changes in 2023 include:

- Client Business Meals: 50% deductible if ordinary and necessary in carrying on business, taxpayer is present, provided to current or potential client or consultant and not lavish or extravagant

- Entertainment Related Meals: 50% deductible if charges are stated separately from the cost of entertainment, no deduction otherwise

- Meals Provided for the Convenience of Employer: 50% deductible

- Meals Provided to Employees Occasionally and Overtime Employee meals: 50% deductible

- Meals in Office during meetings of employees, stockholders, agents or directors: 50% deductible

- Meals During Business Travel: 50% deductible

Barring further action by Congress, many of the TCJA rules are scheduled to expire after 2025 and some may revert to tax rules that were effective in 2017. To learn more, review our chart of meal + entertainment deductions by category and tax year.

Two major changes from the Inflation Reduction Act include Section 179D building deduction changes and the new direct transfer system. These go into effect January 1, 2023.

Section 179D building deduction changes

The Commercial Buildings Energy-Efficiency Tax Deduction (SS179D) provides a deduction of up to $1.88 per square foot for both building owners who construct new or renovate existing energy efficient buildings as well as designers of government-owned buildings. The IRA modifies the tax deduction for energy efficient commercial buildings with new rules for property placed in service Jan 1, 2023. These include:

- Lowering the minimum required savings in total annual energy and power cost

- Removed existing rules for partial certifications

- Provides higher deductions for meeting prevailing wage and apprenticeship requirements

- Removes the lifetime limit, permitting subsequent energy improvements

- Allows allocations of 179D deductions to all tax-exempt entities, and both public and tax-exempt organizations can allocate 179D deductions to their designers.

- Established a new retrofit program

New direct transfer system

Additionally, the IRA created two new credit monetization methods: direct pay for tax-exempt entities and full transferability of credits for taxable entities. This change establishes a market for buying and selling tax credits, as well as including all companies to take advantage of clean energy credits.

Click here to learn more about how these two new credit monetization methods can support your company’s sustainability strategy and lower total tax liability.

Optimize your benefits with the Inflation Reduction Act (IRA) new credits and incentives.

Understanding the opportunity of the new direct transfer system

The passage of the Inflation Reduction Act (IRA) has created a momentous opportunity for companies to advance clean energy commitments while lightening tax burdens. Signed into law on August 16, the IRA is the largest climate investment legislation in history, allocating $369 billion to clean energy programs over the next 10 years—including many new clean energy credits and incentives for businesses.

One of the law’s most significant changes is the creation of two new credit monetization methods: direct pay for tax-exempt entities and full transferability of credits for taxable entities. The transferability provision effectively creates a market for buying and selling tax credits. The new credit market means that any company, not just energy producers, can take advantage of clean energy credits. For example, a company installing a solar facility on the roof of its building may be eligible for credits that it can use or sell to another company. All companies should consider how these credits can support their sustainability strategy and lower total tax liability.

Other key credits and incentives changes in the IRA include:

- Extension of existing clean energy tax credits by 10 years, allowing organizations to plan for the long-term.

- Introduction of a base and bonus rate structure for the Investment Tax Credit (ITC) and Production Tax Credit (PTC), where businesses that meet certain apprenticeship and prevailing wage requirements are eligible for a bonus credit up to five times the base amount. Businesses may also be eligible for additional credits, and by taking advantage of these credits, may be able to achieve a bonus ITC as high as 50-60%. Additional credits include:

- 10% domestic content credit.

- 10% energy communities’ credit.

- 10-20% low-income communities’ credit (applies to solar and wind projects under 5MW and only the ITC).

- Allowance for credits to be carried forward up to 22 years and carried back up to three years.

In addition, while the IRA also introduces a new 15% corporate alternative minimum tax (AMT) that will take effect in 2023, the IRA’s clean energy credits are among the AMT offsets that are available to affected taxpayers. Corporations that expect their total tax liability to increase due to the new AMT should consider buying credits to mitigate the impact.

How sellers can monetize credits

Project owners without significant tax liability must decide whether to monetize credits under the new direct transfer rules or use a traditional tax equity structure. Businesses must weigh both options to determine the best path forward for the business and the project.

Direct credit transfers may avoid higher compliance, legal and advisory costs that come with complex tax equity partnership structures but may not allow for the efficient monetization of depreciation. Based on the size and cost of the project, however, there may be an inflection point at which a traditional tax equity structure will yield greater return over a direct transfer. Building a comparative model—either in-house or by working with an advisor—can help a company determine the best structure for its project.

Another consideration concerns the capital structure for new energy projects. When opting for transferring a tax credit, project owners may have to seek additional capital for the initial investment as the credit transaction timing may not occur until the project is nearing commercial operation. To ensure credits can be sold for maximum value, it is critical for sellers of credits to clearly document that the underlying requirements have been met for the credit to achieve the expected value. Companies looking to sell credits should consider working with an independent tax consultant who can certify the underlying requirements, such as prevailing wage and apprenticeship, in a given project have been met to realize the full expected value.

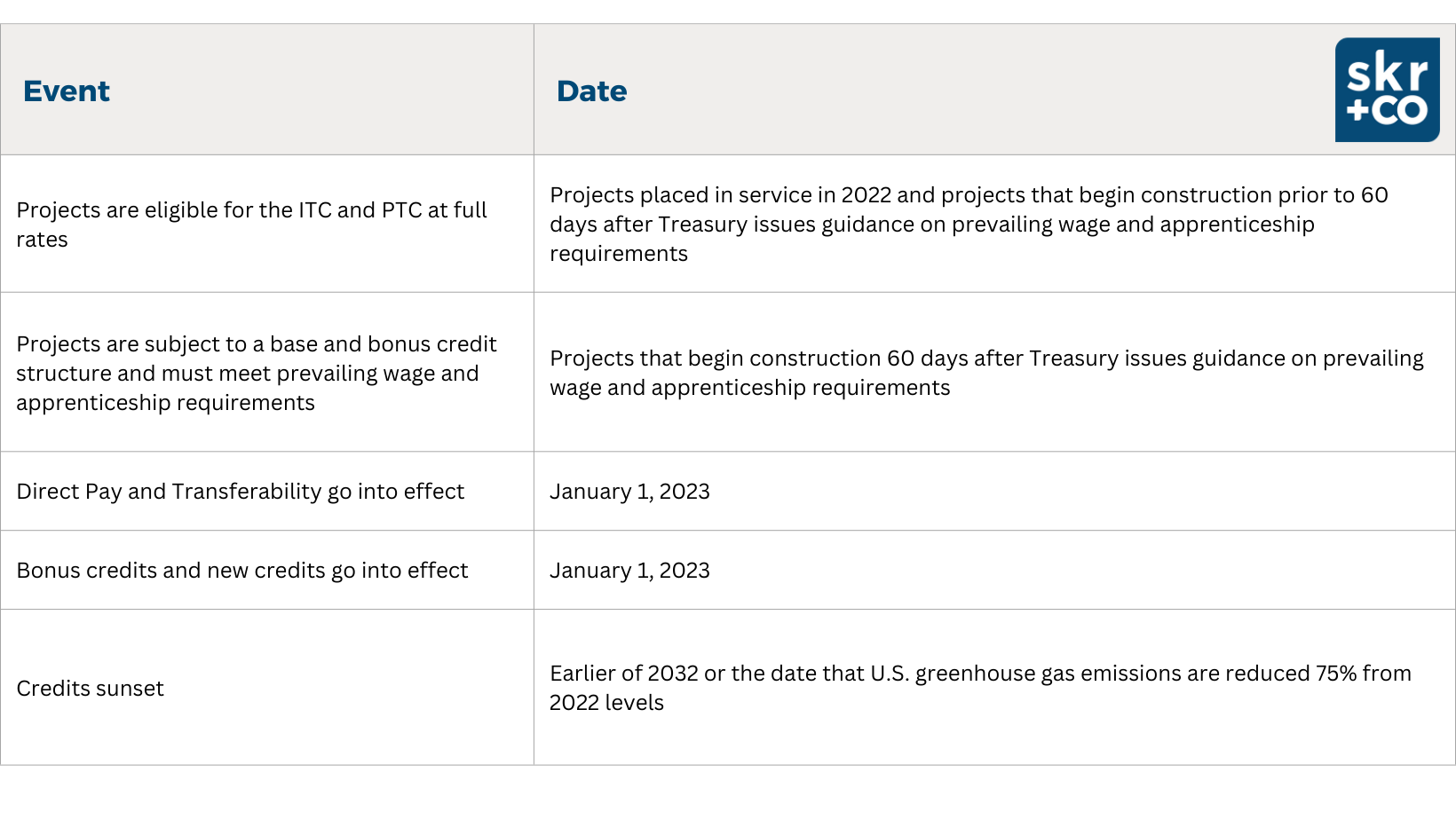

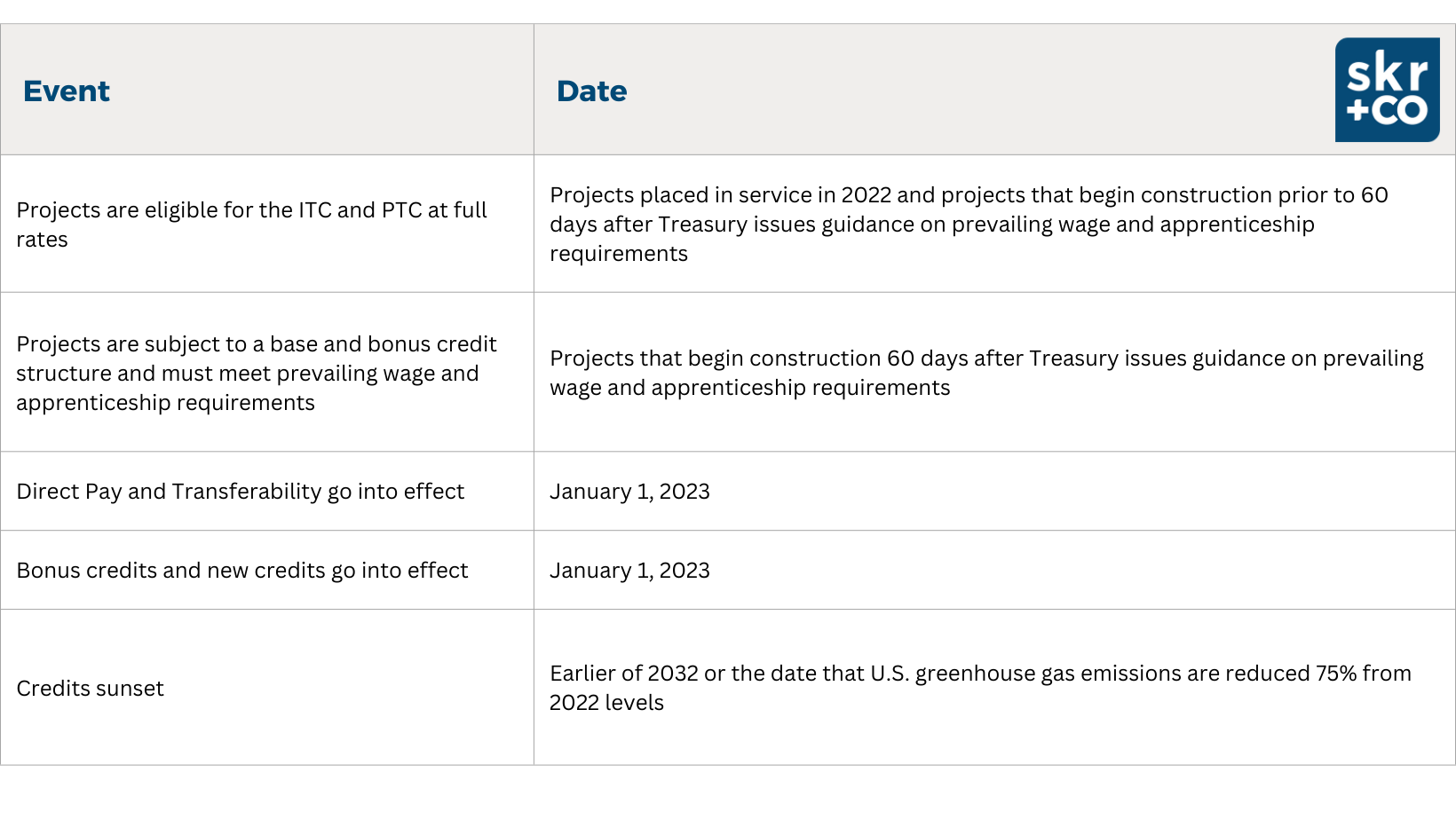

For companies considering a renewable energy project, the time to start construction is now, as projects that are placed in service before year-end, or up to 60 days after the Treasury issues guidance on prevailing wage and apprenticeship requirements, will automatically be eligible for the ITC and PTC at full rates.

While it is still unclear how credits will be valued at the time of sale, the projects that can provide thorough documentation demonstrating credit requirements were achieved will likely transfer at the highest rates.

Considerations for buyers of tax credits

Buyers should perform due diligence on credit sellers’ projects when purchasing credits to confirm the underlying requirements have been met. A buyer who purchases what it believes is a 30% ITC, for example, should be sure that the bonus requirements were satisfied or else risk the purchased credit being worth less than expected. Buyers also need to determine who will take on the risk of recapture or disallowance if the credit does not meet advertised expectations. As the direct transfer market develops, buyers may seek indemnity clauses as part of the credit transfer agreement. Businesses interested in buying credits should consider working with a tax advisor who can help validate credits, ensuring they meet the advertised value.

What’s next for businesses

Treasury is scheduled to issue additional guidance on the prevailing wage and apprenticeship requirements. Here is a calendar of important upcoming dates to watch:

Written by Michael Stavish. Copyright © 2022 BDO USA, LLP. All rights reserved. www.bdo.com