Our client portal will be unavailable from 9PM MST, April 26 until 9PM MST April 28th due to a scheduled maintenance.

Office alert – Friday March 15th, 2024.

Due to the road conditions, majority of our staff will be working remotely today.

We want you to be safe, we have a drop off at COS on 3rd floor. If you are planning to come by the Denver and Springs office please make contact with your SKR contact first.

Our client portal will be unavailable from 9PM MST, April 26 until 9PM MST April 28th due to a scheduled maintenance.

Office alert – Friday March 15th, 2024.

Due to the road conditions, majority of our staff will be working remotely today.

We want you to be safe, we have a drop off at COS on 3rd floor. If you are planning to come by the Denver and Springs office please make contact with your SKR contact first.

Two major changes from the Inflation Reduction Act include Section 179D building deduction changes and the new direct transfer system. These go into effect January 1, 2023.

The Commercial Buildings Energy-Efficiency Tax Deduction (SS179D) provides a deduction of up to $1.88 per square foot for both building owners who construct new or renovate existing energy efficient buildings as well as designers of government-owned buildings. The IRA modifies the tax deduction for energy efficient commercial buildings with new rules for property placed in service Jan 1, 2023. These include:

Additionally, the IRA created two new credit monetization methods: direct pay for tax-exempt entities and full transferability of credits for taxable entities. This change establishes a market for buying and selling tax credits, as well as including all companies to take advantage of clean energy credits.

Click here to learn more about how these two new credit monetization methods can support your company’s sustainability strategy and lower total tax liability.

Optimize your benefits with the Inflation Reduction Act (IRA) new credits and incentives.

The passage of the Inflation Reduction Act (IRA) has created a momentous opportunity for companies to advance clean energy commitments while lightening tax burdens. Signed into law on August 16, the IRA is the largest climate investment legislation in history, allocating $369 billion to clean energy programs over the next 10 years—including many new clean energy credits and incentives for businesses.

One of the law’s most significant changes is the creation of two new credit monetization methods: direct pay for tax-exempt entities and full transferability of credits for taxable entities. The transferability provision effectively creates a market for buying and selling tax credits. The new credit market means that any company, not just energy producers, can take advantage of clean energy credits. For example, a company installing a solar facility on the roof of its building may be eligible for credits that it can use or sell to another company. All companies should consider how these credits can support their sustainability strategy and lower total tax liability.

Other key credits and incentives changes in the IRA include:

In addition, while the IRA also introduces a new 15% corporate alternative minimum tax (AMT) that will take effect in 2023, the IRA’s clean energy credits are among the AMT offsets that are available to affected taxpayers. Corporations that expect their total tax liability to increase due to the new AMT should consider buying credits to mitigate the impact.

Project owners without significant tax liability must decide whether to monetize credits under the new direct transfer rules or use a traditional tax equity structure. Businesses must weigh both options to determine the best path forward for the business and the project.

Direct credit transfers may avoid higher compliance, legal and advisory costs that come with complex tax equity partnership structures but may not allow for the efficient monetization of depreciation. Based on the size and cost of the project, however, there may be an inflection point at which a traditional tax equity structure will yield greater return over a direct transfer. Building a comparative model—either in-house or by working with an advisor—can help a company determine the best structure for its project.

Another consideration concerns the capital structure for new energy projects. When opting for transferring a tax credit, project owners may have to seek additional capital for the initial investment as the credit transaction timing may not occur until the project is nearing commercial operation. To ensure credits can be sold for maximum value, it is critical for sellers of credits to clearly document that the underlying requirements have been met for the credit to achieve the expected value. Companies looking to sell credits should consider working with an independent tax consultant who can certify the underlying requirements, such as prevailing wage and apprenticeship, in a given project have been met to realize the full expected value.

For companies considering a renewable energy project, the time to start construction is now, as projects that are placed in service before year-end, or up to 60 days after the Treasury issues guidance on prevailing wage and apprenticeship requirements, will automatically be eligible for the ITC and PTC at full rates.

While it is still unclear how credits will be valued at the time of sale, the projects that can provide thorough documentation demonstrating credit requirements were achieved will likely transfer at the highest rates.

Buyers should perform due diligence on credit sellers’ projects when purchasing credits to confirm the underlying requirements have been met. A buyer who purchases what it believes is a 30% ITC, for example, should be sure that the bonus requirements were satisfied or else risk the purchased credit being worth less than expected. Buyers also need to determine who will take on the risk of recapture or disallowance if the credit does not meet advertised expectations. As the direct transfer market develops, buyers may seek indemnity clauses as part of the credit transfer agreement. Businesses interested in buying credits should consider working with a tax advisor who can help validate credits, ensuring they meet the advertised value.

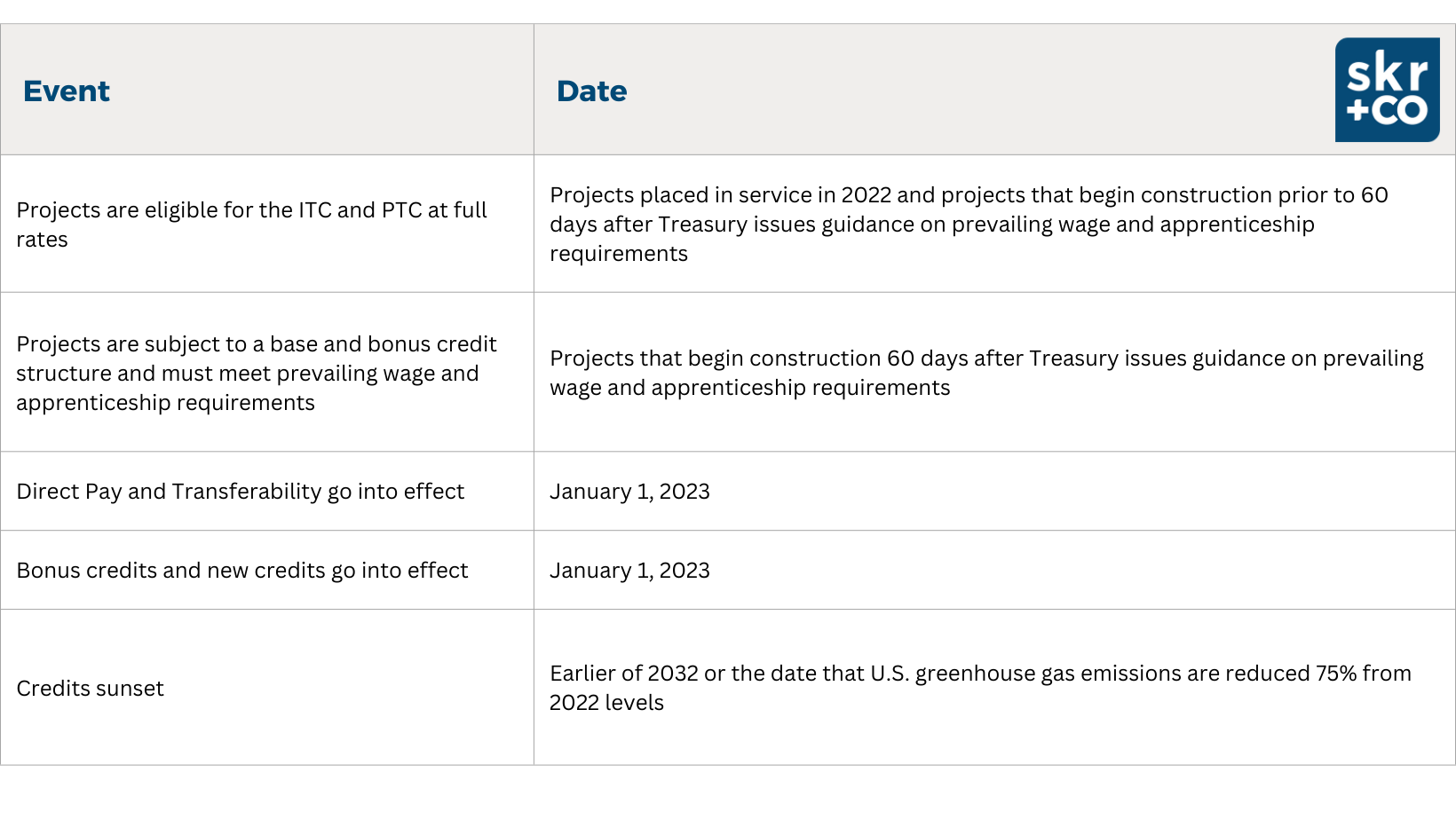

Treasury is scheduled to issue additional guidance on the prevailing wage and apprenticeship requirements. Here is a calendar of important upcoming dates to watch:

Written by Michael Stavish. Copyright © 2022 BDO USA, LLP. All rights reserved. www.bdo.com

The Consolidated Appropriations Act of 2021 (Act), signed into law on December 27, 2020, contains significant enhancements and improvements to the Employee Retention Credit (ERC). The ERC, which was created by the CARES Act on March 27, 2020, is designed to encourage employers (including tax-exempt entities) to keep employees on their payroll and continue providing health benefits during the coronavirus pandemic. The ERC is a refundable payroll tax credit for wages paid and health coverage provided by an employer whose operations were either fully or partially suspended due to a COVID-19-related governmental order or that experienced a significant reduction in gross receipts.

Employers may use ERCs to offset federal payroll tax deposits, including the employee FICA and income tax withholding components of the employer’s federal payroll tax deposits.

ERC for 2020

The Act makes the following retroactive changes to the ERC, which apply during the period March 13, 2020 through December 31, 2020:

Insights

ERC for 2021 (January 1 – June 30, 2021)

In addition to the retroactive changes listed above, the following changes to the ERC apply from January 1 to June 30, 2021:

Increased Credit Amount

Broadened Eligibility Requirements

Determination of Qualified Wages

Advance Payments

Insights

The Act may provide significant opportunities for your company. However, the interplay between the Act, the CARES Act and various Internal Revenue Code sections is nuanced and complicated so professional advice may be needed.

Under the pre-Act rules, you could deduct interest on up to a total of $1 million of mortgage debt used to acquire your principal residence and a second home, i.e., acquisition debt. For a married taxpayer filing separately, the limit was $500,000. You could also deduct interest on home equity debt, i.e., debt secured by the qualifying homes. Qualifying home equity debt was limited to the lesser of $100,000 ($50,000 for a married taxpayer filing separately), or the taxpayer’s equity in the home or homes (the excess of the value of the home over the acquisition debt). The funds obtained via a home equity loan did not have to be used to acquire or improve the homes. So you could use home equity debt to pay for education, travel, health care, etc.

Under the TCJA, starting in 2018, the limit on qualifying acquisition debt is reduced to $750,000 ($375,000 for a married taxpayer filing separately). However, for acquisition debt incurred before Dec. 15, 2017, the higher pre-Act limit applies. The higher pre-Act limit also applies to debt arising from refinancing pre-Dec. 15, 2017 acquisition debt, to the extent the debt resulting from the refinancing does not exceed the original debt amount. This means you can refinance up to $1 million of pre-Dec. 15, 2017 acquisition debt in the future and not be subject to the reduced limitation.

And, importantly, starting in 2018, there is no longer a deduction for interest on home equity debt. This applies regardless of when the home equity debt was incurred. Accordingly, if you are considering incurring home equity debt in the future, you should take this factor into consideration. And if you currently have outstanding home equity debt, be prepared to lose the interest deduction for it, starting in 2018. (You will still be able to deduct it on your 2017 tax return, filed in 2018.)

Lastly, both of these changes last for eight years, through 2025. In 2026, the pre-Act rules come back into effect. So beginning in 2026, interest on home equity loans will be deductible again, and the limit on qualifying acquisition debt will be raised back to $1 million ($500,000 for married separate filers).

Before Tax Rerfom changes were effective, individuals were permitted to claim the following types of taxes as itemized deductions, even if they were not business related:

Taxpayers could elect to deduct state and local general sales taxes in lieu of the itemized deduction for state and local income taxes.

New SALT Deduction Limits

For tax years 2018 through 2025, new tax reform laws limit deductions for taxes paid by individual taxpayers in the following ways:

Under pre-Act law, the child tax credit was $1,000 per qualifying child, but it was reduced for married couples filing jointly by $50 for every $1,000 (or part of a $1,000) by which their adjusted gross income (AGI) exceeded $110,000. (The threshold was $55,000 for married couples filing separately, and $75,000 for unmarried taxpayers.) To the extent the $1,000-per-child credit exceeded your tax liability, it resulted in a refund up to 15% of your earned income (e.g., wages, or net self-employment income) above $3,000. For taxpayers with three or more qualifying children, the excess of the taxpayer’s social security taxes for the year over the taxpayer’s earned income credit for the year was refundable. In all cases the refund was limited to $1,000 per qualifying child.

Starting in 2018, the TCJA doubles the child tax credit to $2,000 per qualifying child under 17. It also allows a new $500 credit (per dependent) for any of your dependents who are not qualifying children under 17. There is no age limit for the $500 credit, but the tax tests for dependency must be met. Under the Act, the refundable portion of the credit is increased to a maximum of $1,400 per qualifying child. In addition, the earned threshold is decreased to $2,500 (from $3,000 under pre-Act law), which has the potential to result in a larger refund. The $500 credit for dependents other than qualifying children is nonrefundable.

The Act also substantially increases the “phase-out” thresholds for the credit. Starting in 2018, the total credit amount allowed to a married couple filing jointly is reduced by $50 for every $1,000 (or part of a $1,000) by which their AGI exceeds $400,000 (up from the pre-Act threshold of $110,000). The threshold is $200,000 for all other taxpayers. So, if you were previously prohibited from taking the credit because your AGI was too high, you may now be eligible to claim the credit.

In order to claim the credit for a qualifying child, you must include that child’s Social Security number (SSN) on your tax return. Under pre-Act law you could also use an individual taxpayer identification number (ITIN) or adoption taxpayer identification number (ATIN). If a qualifying child does not have an SSN, you will not be able to claim the $2,000 credit, but you can claim the $500 credit for that child using an ITIN or an ATIN. The SSN requirement does not apply for non-qualifying-child dependents, but you must provide an ITIN or ATIN for each dependent for whom you are claiming a $500 credit.

The changes made by the Act should make these credits more valuable and more widely available to many taxpayers.

Starting in 2019, the TCJA has eliminated the shared responsibility payment, more commonly known as the “individual mandate,” that penalizes individuals who are not covered by a health care plan that provides at least minimum essential coverage, as outlined in the Affordable Care Act of 2010 (ACA). Since this penalty is only eliminated starting in 2019, you still need to take account of it in making your health care decisions for 2018.

For individuals who do not have the required health coverage in 2018, the minimum annual penalty is $695 per adult and $347.50 for each child under 18. The maximum annual penalty can be substantially higher based on household income. The penalty applies for each month for which the required coverage is not in place, and is based on 1/12 of the annual penalty amount. Certain individuals may be exempt based on household income or other factors.

The California Tax Code imposes two parallel taxes on corporations, a franchise tax and an income tax. The franchise tax is imposed on corporations that are considered to be “doing business” in California. Such corporations are subject to the $800 annual franchise tax regardless of whether they had income or not.

tax is imposed on corporations that are considered to be “doing business” in California. Such corporations are subject to the $800 annual franchise tax regardless of whether they had income or not.

In 2013 Swart Enterprises, Inc. (Swart) challenged the Franchise Tax Board (FTB) of California. The Iowa based company had invested $50,000 into a California LCC investment fund with a total ownership interest of 0.2%. The fund invested in capital equipment in California and other states, and was actively managed by a California corporate manager. Swart had no other connection to California other than this passive investment and did not file a California tax return since there was no California income. Swart received a notice from the California FTB requesting the $800 minimum tax plus interest and penalties. Swart paid the requested amount due, but filed for a refund. The trial court awarded judgement to Swart based on the fact that they were not “doing business” in California.

The California FTB decided to appeal the decision to the Court of Appeals (COA). On January 12, 2017, the COA rejected the FTB’s claim that Swart should be subject to the $800 minimum tax. The FTB can now file a petition with the California Supreme Court, but must do so within 40 days of the COA ruling. Although the COA judgement is a win a for taxpayers, it should be noted that the Swart ruling does not apply if the corporation has California source income and that the court’s decision was based on very specific and narrow set of facts.

The court’s decision was based upon the facts that Swart held a limited partnership interest in the California LLC because of these specific facts.

The most important factor noted in the case was that Swart could not make management decisions. The fund invested into contained its own manager of the fund that made decisions versus Swart having the ability to make decisions. An LLC that is managed by a manager instead of its members and the exclusive authority is given to the LLC’s manager were key factors in the court’s decision to side with the taxpayer.

The California FTB ultimately did not appeal the decision to the California Supreme Court; setting the precedent for other organizations.

The decision on whether to file a California return must still be done on a case by case basis. Many other states do not require the articles of organization to describe whether the LLC is managed by a manager or member managed.

If you are a corporation or an LLC and have an investment in a California based partnership, please discuss the facts with your tax preparer to decide if there is a California filing requirement.